Stock Market Early Morning Insights – June 14, 2016

Stock Market Early Morning Insights – June 14, 2016

The character of this market has changed completely over the past three or four days. Strong short term uptrends have turned negative as the broader market experienced another distribution day. The SP 400 and SP 600 both went from bullish control based upon the VPOC 10/10 to bearish control.

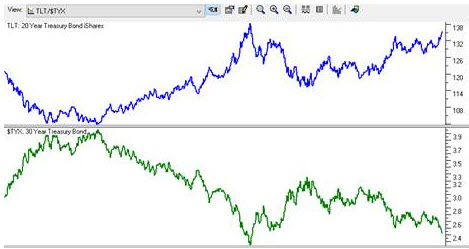

30-year Treasury Bond futures are approaching record highs, which means that yields are approaching new lows. This is a chart I created this morning to show the relative direction of the 20-Year Treasury Bond ETF, the TLT, compared to the yield on the 30-Year Treasury Bond. When fear is increasing, the bonds spike higher, and yields go down. Additionally, the VIX is trading at levels we have not seen since February, so fear is beginning to take hold.

Even though there are many things to worry about, resistance above the indexes, Brexit, a slowing world economy, and the Fed, I am not seeing panic selling on heavy volume. This could be because complacency abounds, or because we are into the summer trading season. I am betting it is a little bit of both.

Decliners swamped advancers yesterday and investors look for safety in the REITs and some utility stocks. When the decliners are so dominant, it is hard to find a place to hide, and long side stock selection becomes extremely difficult. Unless we have a complete market meltdown, there will be long side trades to put on, but the odds are against you.

I’m sure you’ve all read the news about Microsoft acquiring LinkedIn. Microsoft’s acquisitions over the years have generally been a waste of money so will see how this one works out. I don’t see the synergy, but evidently Microsoft does. Of course, Ballmer thought he saw that synergy with Nokia, but that turned out to be another financial disaster. With the LinkedIn acquisition, speculators are hoping that Twitter is the next takeover target. Personally, I use Twitter very little because I consider it just another distraction, but I know a lot of people like it.

Stock index futures are down again this morning following the lead of most world market indexes from Asia to Europe. If you want a quick read on the world markets, there is no better site than Investing.com. This is a direct link to the Major World Indices. http://www.investing.com/indices/major-indices. This is the first site that I check when I get up in the morning.

The major indexes are in that limbo area between support and resistance. The short-term biases to the downside, but until we break support, or power up through resistance, there is no clear sense of direction for the long and intermediate terms. Risk is very high as we are seeing in the VIX and him bond yields. Oil futures have fallen back due to a stronger dollar. Now may be a good time just to stand aside unless you are a great stock picker.

STOCK MARKET EARLY MORNING INSIGHTS

Stock Market Early Morning Insights is a product of Ron Brown Investing. The complete report and all the charts are produced daily before the market opens and distributed by email to subscribers. Reports published on the HGSI Blog are delayed and do not contain all the charts. For more information about subscribing use this link. MORE INFO

Comments are closed.