Stock Market Early Morning Insights – July 26, 2016

Stock Market Early Morning Insights – July 26, 2016

It’s time again for the quarterly obsession with Apple’s earnings. The company reports after the market closes, and the expectation is for earnings of about $1.39 per share. There is widespread interest in Apple’s earnings because it is so widely held by both individual investors and institutions, but Apple has stagnated for months, and remains in a downtrend.

The stock is currently trading at the same level as October 2014, so the buy-and-hold investors have been disappointed with price appreciation, but they are collecting a 57 cent quarterly dividend, if that is some consolation. Apple ranks number 1159th out of the S&P 1500 stocks using IanSlow, or a relative strength ranking based upon the last six months with 70% of the emphasis on the last three months. In other words, it has been dead money for the longer term holders. Short-term options traders love Apple because it is the most liquid stock out there.

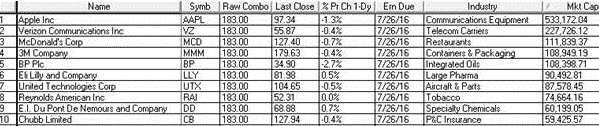

Today is a big earnings day with several of the Dow Jones 30 stocks reporting today. This is a list of the top 10 market cap stocks which are due to report sometime today. Note that the list contains several DJ 30 stocks. The list is sorted by market capitalization.

Earnings season is really beginning to ramp up, and we all need to be aware of earning dates for any of our holdings or potential trades. The earnings date is reported in the HGSI chart fundamental view on the right-hand side.

Yesterday was once again dominated by the Semiconductor Devices. The top 50 GIR contains 10 Semiconductor Devices, and most of them are stocks have previously appeared in the list, or in the Stocks and Groups Moving up Smartgroup.

Semiconductors were joined by Infrastructure Software and Internet Media stocks in the top 50. Energy stocks dominated the Stocks and Groups Moving to the Downside SmartGroup. This will continue to be the case as long as oil continues to fall, and it is down another 1.28% today, well below the $45 level I suggested as support a few days ago. Crude light futures are clearly in a downtrend.

Even though yesterday was negative throughout the day for most of the stock indexes, the NASDAQ composite closed strongly at 82.89% of its daily range. Once again, selling was absorbed by buyers. Volume was slightly heavier yesterday for the NASDAQ composite, but was still slightly below average.

The stock indexes continue to look bullish to me, and the path of least resistance seems to be up. The S&P 400 Midcap and the S&P 600 Smallcap indexes are still holding their flags, but they are starting to get a little bit droopy. Still, the trends all remain up.

STOCK MARKET EARLY MORNING INSIGHTS

Stock Market Early Morning Insights is a product of Ron Brown Investing. The complete report and all the charts are produced daily before the market opens and distributed by email to subscribers. Reports published on the HGSI Blog are delayed and do not contain all the charts. For more information about subscribing use this link. MORE INFO

Comments are closed.