Stock Market Early Morning Insights – July 1, 2016

Stock Market Early Morning Insights – July 1, 2016

As I did my market analysis this morning I was surprised to learn that the most in demand industry groups and sectors yesterday were conservative stocks. The Consumer Staples index and the Utilities Index led the sectors with the most number of advancing issues versus declining issues.

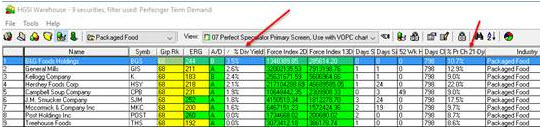

The most in demand groups based upon my demand combo were Packaged Food, Utility Networks, Beverages, and REITs. I’m not quite sure what this is telling us, but most of the stocks are dominated by institutions and that is where much of their money seems to be flowing rather than into the more speculative groups. If you scroll down to the industry groups, they are sorted by the demand combo, and you will see that conservative groups, and Precious Metals and Mining were the most in demand. The top 50 GIR was dominated by the Packaged Food group and REITs. There were very few speculative type stocks in today’s list.

Hershey Foods was the dominant stock in the Packaged Food group on buyout rumors, but the other stocks in the group have been doing very well. This is a snapshot of nine stocks in the group which are out to all-time highs. Most of these stocks pay a dividend, and are often overlooked by the individual investor because they are not considered so-called New America or CANSLIM stocks.

Semiconductor Devices had a good day based upon advancing issues versus declining issues, but it was one of the harder hit groups during the Brexit debacle. The best looking stock in the Semiconductor Devices group is SIMO which is been in a long-term uptrend. During the correction, it held at the 50 day exponential moving average, and bounced sharply from that level.

After three days of strong candles closing at the top of their daily ranges, I doubt if there will be much profit-taking today only because days before holiday weekends are generally positive. Volume should fall off today as traders take an extended weekend. I was surprised that the volume was so strong yesterday, but I believe there is still substantial short covering occurring, and we must never forget the power of institutions. They have the buying power, and they certainly do not want this market to go down after another six months of mediocre performance.

Another thing we have to consider is that with the recent instability and volatility in the indexes, interest rate hikes will probably not happen in the near term. With the Fed and the EU bankers propping the market up with low interest rates, there are few places to make any kind of return other than stocks.

Stock futures are essentially flat this morning, but gold futures are up 1.2% and the 30-year bond is up 1.32%. Crude light is down .43%, and the Dollar Index is down. Bonds are trading at record levels with the 30-year bond yielding around 2 ¼%. I assume this is one of the primary reasons we are seeing money continuing to flow into REITs, Utilities and other conservative stocks with a dividend yield.

Even with the massive up move over the past three days, the NASDAQ composite is still within its trading range. I know a lot of so-called gurus who have been short over the past three days and are looking for this market to continue down. These have been a painful three days for them after a couple of days of euphoria. When I take a look at the daily and weekly charts of the major market indexes, I have to come to the conclusion that they are trendless. This does not mean that there are not opportunities in certain groups. Just take a look at the Packaged Food group to see what I mean.

Have a happy and safe July 4th weekend.

STOCK MARKET EARLY MORNING INSIGHTS

Stock Market Early Morning Insights is a product of Ron Brown Investing. The complete report and all the charts are produced daily before the market opens and distributed by email to subscribers. Reports published on the HGSI Blog are delayed and do not contain all the charts. For more information about subscribing use this link. MORE INFO

Comments are closed.